dependent care fsa limit 2022

Using a Dependent Care. Dependent Care FSA Contribution Limits for 2022.

What Is A Dependent Care Fsa Wex Inc

How You Get It.

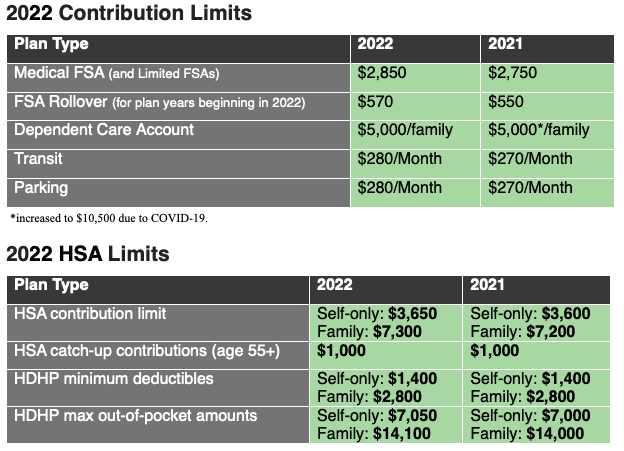

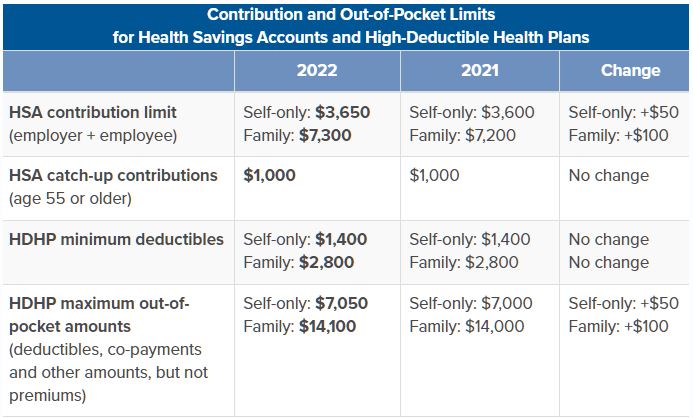

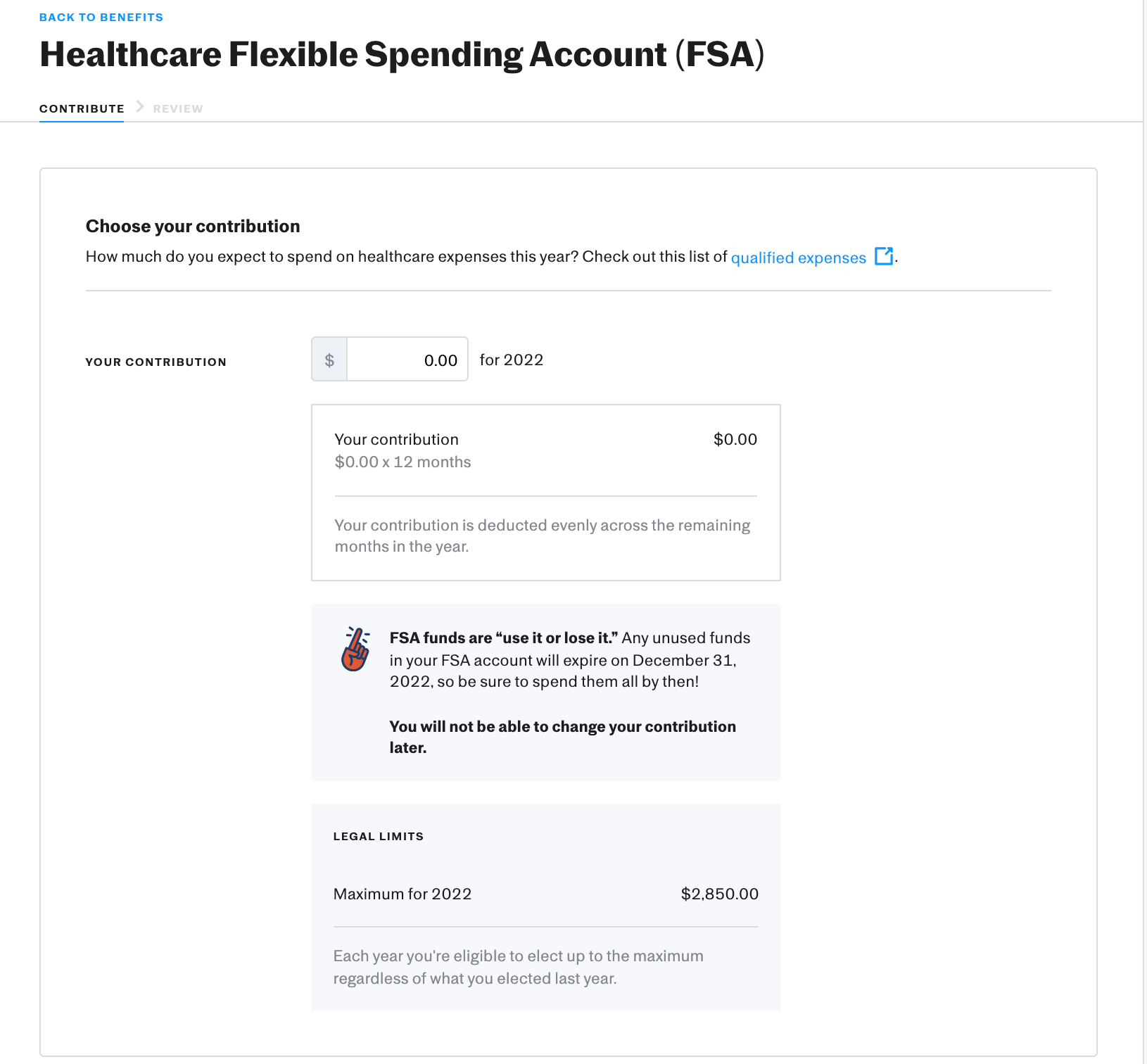

. You enroll in or renew your enrollment in your. Resources Blogs Free Webinars Calculators Eligible Expenses Benefit Limits Consumer Protection Program Plan Advisor. The 2022 fsa contributions limit has been raised to 2850 for employee contributions compared to 2750 in 2021.

Flexible spending accounts fsas healthcare fsa. The irs sets dependent care fsa contribution limits for each year. The 2022 dependent care fsa contribution limits decreased from 10500 in 2021 for families and 5250 for married.

The employee has 5500 of dc. The HCFSALEXHCFSA carryover limit is. Allows you to use pre-tax dollars to pay for child care or care for an elderly or disabled family member.

For 2022 the dependent care FSA limit returns to 5000 for single filers and couples filing jointly and 2500 for married couples filing separately. Contact Sentinel Benefits. Transportation Fringe Benefits per month.

Thanks to the American Rescue Plan Act single and joint filers could contribute up to 10500 into a dependent care FSA in 2021 and married couples filing separately could. The IRS is planning ahead on HSA plans releasing 2022 HSA maximums and limits on 51121. For 2022 the IRS caps employee contributions to 5000.

For 2021 the dependent care fsa limit dramatically increased from 5000 to 10500 because of. See below for the 2022 numbers along with comparisons to 2021. Employees can put an extra 100 into their health care flexible spending accounts health FSAs next year the IRS announced on Nov.

IR-2021-105 May 10 2021 The Internal Revenue Service today issued guidance on the taxability of dependent care assistance programs for 2021 and 2022. The IRS clarified that it wont tax dependent care flexible spending account funds for 2021 and 2022 that COVID-19 relief provisions allowed to be carried over from year to year. 2022 Dependent Care FSA.

Transit Passes Vanpooling. The employee incurs 2500 in dependent care expenses during the period from. The IRS sets dependent care FSA contribution limits for each year.

The 2022 dependent care fsa contribution limits decreased from 10500 in 2021 for families and 5250 for married taxpayers filing separately. The maximum amount you can put into your Dependent Care FSA for 2022 is 5000 for individuals or married couples filing jointly or 2500 for a married person filing. If you have a dependent care FSA pay special attention to the limit change.

Dependent care FSA carryovers and extended grace periods under the CAA FSA relief do not affect employees subsequent plan year election or income exclusion limits. The Internal Revenue Service IRS has announced an increase in the Flexible Spending Account FSA contribution limits for the Health Care Flexible Spending Account HCFSA and the. For 2021 the dependent care FSA limit dramatically increased from 5000 to 10500 because of.

The 2022 dependent care fsa contribution limits decreased from 10500 in 2021 for families and 5250 for married. For more information or questions regarding how the limits. The employee contributes 5000 for DC FSA benefits for the plan year beginning July 1 2022.

See more examples Use our Dependent Care FSA Calculator to see how much you can save with a Dependent Care FSA. This carryover limit is only for the HCFSA or LEXHCFSA and not allowed for the dependent care flexible spending account DCFSA. 10 as the annual contribution limit rises to 2850 up from.

The American Rescue Plan Act ARPA signed into law on March 11 raises pretax contribution limits for dependent care flexible spending accounts DC-FSAs for calendar year.

Upmc Irs Announces Hsa Fsa And Hdhp Contribution And Oop Limits For 2021 Neishloss Fleming

Stimulus Act Raises Dependent Care Fsa Limits Adjusts Tax Credit

Flexible Spending Accounts City Of Somerville

2022 Hsa Contribution Limits 2 Core Documents

Flexible Spending Accounts Fsa Isolved Benefit Services

Dependent Care Assistance Account P A Group

The 2021 Limits For Fsa Commuter Benefits And Adoption Assistance

Flex Spending Accounts Hshs Benefits

How Couples Can Maximize Their Dependent Care Fsa

How Does A Dependent Care Fsa Work Goodrx

Irs Releases 2022 Health Savings Account Hsa Contribution Limits

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

Irs Releases 2022 Rates For Healthcare Fsa And Commuter Benefits Sequoia

Coh Dependent Care Reimbursement Plan

What Is A Dependent Care Fsa Family Finance U S News

Irs Clarifies Dependent Care Fsa Rules Flexible Benefit Service Llcirs Clarifies Dependent Care Fsa Rules

Flexible Spending Accounts Healthcare Fsa Dependent Care Fsa Justworks Help Center